Sea Purity Investment Portfolio

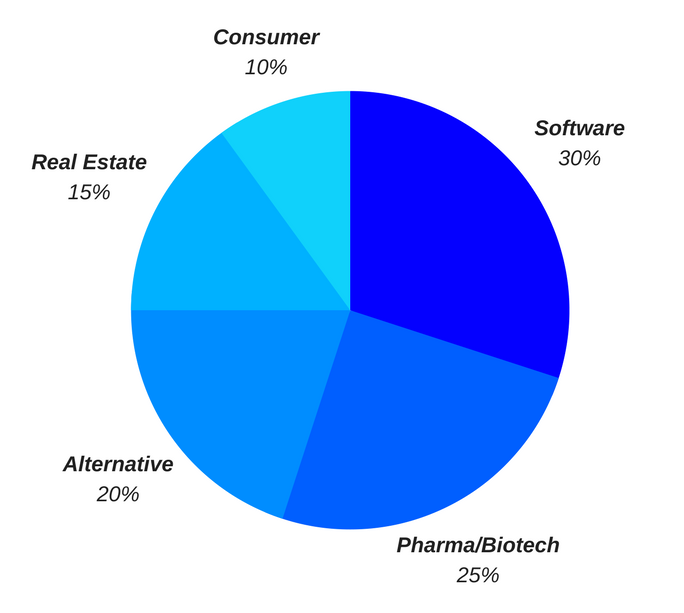

Software Vertical

Disruptive Technology Products

Socially Responsible Investing

Pharma / Biotech

Medtech / Device

Consumer

Alternative Funds

Real Estate

Significant Wins and Exits

Location

San Clemente, CA, United States

Phone

949-391-0980

matt.hayden@seapurity.us